When your home is damaged by fire, flooding, storms or any other unexpected disaster, your world is turned upside down. It’s a stressful time: there’s mess, confusion and a mountain of questions. One of the biggest and most costly mistakes homeowners make is calling their insurance company first without getting proper advice. That’s where All Property Claims (APC) comes in.

We’re an expert insurance claims management company based in Wimbledon, and we specialise in helping homeowners like you through the chaos of property claims. From assessing damage to negotiating with insurers and managing the entire restoration, we handle everything on your behalf so you don’t have to.

Let’s break down why calling APC first is not just a smart move, it’s essential.

Why You Shouldn’t Contact Your Insurer First

Most people assume they should contact their insurer as soon as something goes wrong. It’s a natural reaction, but it can work against you.

When you notify your insurer first:

- They’ll appoint their own insurance surveyor, whose priority is to protect their bottom line – not yours.

- You may be pressured to accept quick settlements before full damage is assessed.

- Insurers often use their own contractors, who may work to the lowest budget.

- You risk missing out on entitlements hidden in the fine print of your policy.

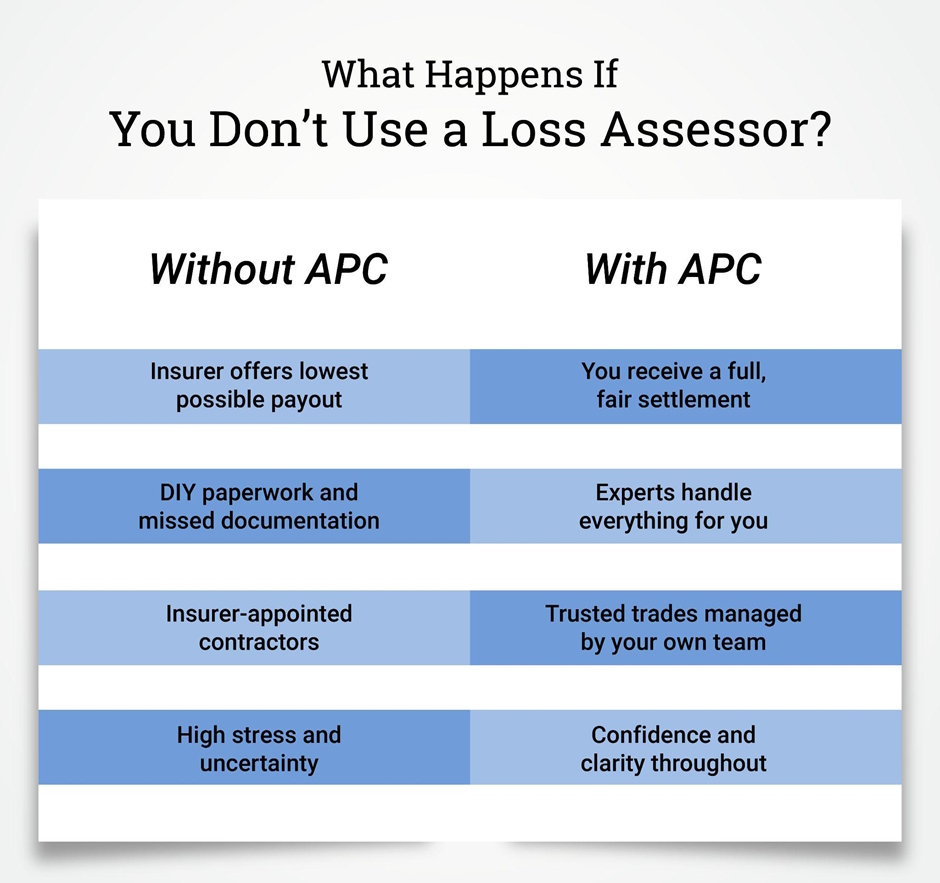

What many don’t realise is that your insurer’s goal is to minimise the payout, and unless you’ve got someone fighting your corner, you could lose thousands in unrecovered costs.

Why All Property Claims Should Be Your First Call

At All Property Claims, we work for you, not your insurer. We’re independent loss assessors and insurance claims experts who specialise in:

- Maximising your home insurance claim

- Handling the paperwork, negotiation and communication

- Overseeing repairs and restoration

- Ensuring you’re fully compensated for both visible and hidden damage

We’ve helped countless homeowners in Wimbledon and across the UK recover from disasters with less stress, fewer delays and much better financial outcomes.

How APC Handles Your Home Insurance Claim

Here’s exactly what happens when you choose APC to manage your home insurance claims:

1. Free Initial Consultation

We’ll visit your property – often within 24 hours – to assess the situation. This is a free, no-obligation visit where we’ll listen, offer advice and begin documenting the damage.

2. Full Damage Assessment

Our experienced surveyors conduct a comprehensive inspection of your property. We don’t just look at what’s obvious, we look at everything insurers often overlook, like structural weakening, water ingress, smoke damage to wiring or lingering mould issues.

3. Detailed Policy Review

We examine your home insurance policy with a fine-tooth comb to ensure that you receive everything you’re entitled to. Our team knows how to interpret complex wording and spot the fine print insurers may use to avoid paying out.

4. Claim Preparation and Submission

Once we’ve gathered all the information, we prepare a thorough, professionally presented claim on your behalf. This includes itemised damage reports, cost estimates, photographs and all required documentation.

5. Direct Negotiation with the Insurer

This is where our value really shines. We manage direct negotiations with your insurer, using our evidence and expertise to ensure your settlement is fair, complete and reflective of the true cost of restoring your home.

6. Complete Restoration Management

Once your claim is approved, we help you find trusted local contractors – or manage the restoration ourselves – to ensure your home is repaired to the highest standard. No cutting corners. No stress.

What Makes APC Different?

Here’s why homeowners in Wimbledon and across the UK trust us with their property claims:

We’re Independent Loss Assessors

Unlike the insurance surveyor your insurer sends, we don’t work for them. We work for you. Our only job is to make sure you’re looked after properly and compensated fully.

We’re Fully Qualified and Experienced

Our team has decades of combined experience in home insurance claims, surveying, property restoration and negotiations. We know how to handle even the most complex cases.

We Remove the Stress

You don’t need to fill in endless forms or chase insurers. You don’t need to argue over costs or deadlines. We handle everything, while keeping you informed at every step.

We’re Wimbledon-Based

We’re proud to be based in Wimbledon and have supported homeowners across South West London for years. We understand the local housing stock, the value of properties, and the common insurance issues in the area.

What Types of Claims Do We Help With?

We specialise in:

- Fire and smoke damage

- Flooding and water damage

- Storm damage and fallen trees

- Subsidence and structural issues

- Theft, vandalism and criminal damage

- Oil leaks, burst pipes, mould and more

Whether it’s a small leak or a large-scale rebuild, we treat every client’s claim with the same care and attention.

Take Control of Your Claim Today

If you’ve suffered home damage, don’t risk under-settlement or added stress by going it alone. Let All Property Claims manage your insurance process from day one. Whether it’s a burst pipe, kitchen fire, storm-damaged roof or collapsed ceiling, we’re ready to help. Contact us today for more information and let us take the burden off your shoulders.