House fires affect over 30,000 homes across the UK each year, leaving families devastated and facing an overwhelming recovery process. Beyond the immediate safety concerns and emotional trauma, homeowners are left to deal with the complexities of insurance claims to rebuild their lives. Poorly handled fire damage claims result in homeowners receiving settlements that cover less than one-third of actual restoration costs, leaving victims financially strained.

If you’ve been impacted by fire in the home, understanding the fire damage claim assessment process can mean the difference between a fair settlement and financial hardship. At All Property Claims, we’ve seen firsthand how proper assessment and expert guidance can turn a stressful process into a smooth journey to recovery.

Understanding Fire Damage Insurance Claims

A fire damage insurance claim involves more than simply reporting the incident to your insurer. The process requires careful documentation, thorough assessment, and careful negotiation to ensure you’re compensated correctly. Many homeowners underestimate the work involved, which often leads to insufficient settlements that fail to cover the actual cost of restoration.

The reality is that fire damage extends far beyond what can be seen at first glance. While charred walls and burned furniture are obvious, the real challenge lies in identifying hidden damage that can significantly impact the safety and value of your property. Smoke contamination can penetrate deep into wall cavities and floor voids, requiring extensive restoration work. Water damage from firefighting efforts often causes secondary issues like mould growth and structural weakening. These hidden problems, if missed during the initial assessment, can result in you having to pay for extra work.

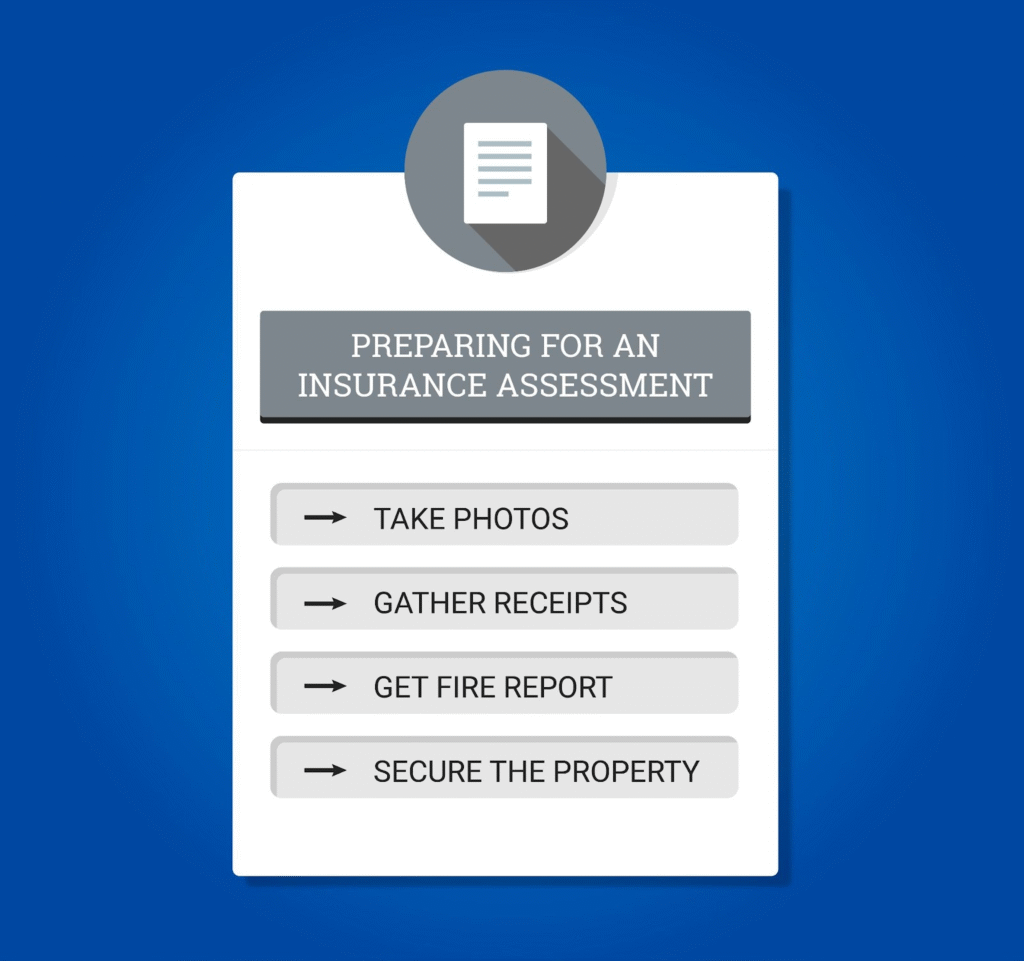

Essential Preparation Before the Assessment

Document Everything Immediately

The moments following a fire are crucial for building a strong home insurance fire damage claim. Before any cleanup begins, take extensive photographs and videos of all damage throughout your property. Capture smoke staining, water damage, structural issues, and damaged belongings from multiple angles. Don’t overlook areas that might seem minimally affected, such as garages, sheds, basements, and attics, where smoke damage often goes unnoticed.

Gather Documentation

Your insurance assessor will need access to relevant documents to process your fire damage insurance claim effectively. Start by locating your policy documents and creating a detailed, room-by-room inventory of damaged items. Include descriptions, approximate ages, and replacement costs for each item. Financial records strengthen your claim, so gather receipts, warranties, and proof of purchase for valuable belongings. Bank statements often come in handy when the original receipts are unavailable.

Contact the fire service to obtain an incident report number and any documentation from attending firefighters. If you’ve made emergency repairs to prevent further damage, keep detailed records and receipts. For properties with unique architectural features or historical significance, or those subject to conservation restrictions, gather building plans and architectural drawings, as these features may impact rebuilding costs. If you’ve lost these in the fire, reach out to your local council’s planning portal.

Secure Your Property

You have a legal responsibility to prevent further damage to your property. This includes boarding up broken windows and doors, stabilising damaged structures, and protecting exposed areas from the weather. Keep detailed records of all security measures, as these costs are typically recoverable through your insurance claim. Failing to follow this step can compromise your claim.

The Fire Damage Claim Assessment Process

Step 1: Initial Contact and Survey Arrangement

When you contact All Property Claims for insurance claims management, we immediately gather your insurer’s details and arrange a convenient survey appointment to assess the extent of the damage. Our team ensures we have all the necessary information to begin the process efficiently, removing the burden of coordinating with your insurance company during this difficult time.

Step 2: Property Survey

Our experienced surveyors conduct thorough inspections that go far beyond surface-level damage assessment. During the visit, we take precise measurements, comprehensive photographs, and detailed notes about all damage throughout your property. We document the incident circumstances and identify both obvious and hidden damages that inexperienced assessors might overlook. We then use this information to generate a report and quote for the works ready for your insurance provider. At All Property Claims, we handle the entire process, including restoration, saving you time and increasing your chances of receiving full coverage for the affected areas.

Step 3: Report Submission and Loss Adjuster Appointment

We will provide a detailed report to your insurer and request an appointment with a loss adjuster. This rapid turnaround ensures your claim moves forward quickly, preventing delays that could complicate the process.

The loss adjuster, appointed by your insurance company, assesses the validity of your claim and determines the settlement amount. To ensure the best outcome, our surveyor meets with the loss adjuster to review all documented damages and agree on fair compensation. Our expertise in insurance claims management ensures that nothing gets overlooked during the negotiation phase.

What to Expect During the Assessment Visit

Prepare for Questions

Familiarise yourself with your policy documents before the assessment. The insurance assessor will ask specific questions about the incident, the condition of your property before the fire, and the circumstances surrounding the damage. Create a factual timeline of events and be prepared to provide honest, straightforward answers while avoiding unnecessary details that don’t relate to your claim.

Active Participation in the Inspection

Accompany the assessor during their property inspection to highlight hidden damage they might miss. Point out areas where smoke infiltration occurred, water damage from firefighting efforts, and any structural concerns you’ve noticed. Your intimate knowledge of your home’s pre-fire condition is invaluable for ensuring comprehensive damage assessment.

How All Property Claims Streamline Your Fire Damage Claim

Expert Damage Identification

The average fire damage restoration costs around £35,000 per property, yet the typical fire damage insurance claim settles for only £11,000. This discrepancy largely stems from inadequate damage assessment and poor negotiation. Our expertise in identifying damage, combined with our knowledge of the insurance industry and restoration process, ensures your payout accurately reflects the actual costs.

End-to-End Claims Management

Let us handle your fire damage claim from initial assessment through to final restoration. We’ll coordinate with your insurer, manage all documentation, and oversee the entire process.

Proven Success Rate

Less than 0.5% of claims presented by All Property Claims have been refused by insurers. Our thorough documentation and assessment process, combined with industry expertise, enables us to secure swift resolutions and fair settlements for our clients.

Complete Peace of Mind with All Property Claims

You’re not alone. At All Property Claims, we understand the emotional and financial stress that follows a house fire. Our team provides round-the-clock support, guiding you through every step of the assessment and restoration process. With our proven track record of successful settlements, you can trust All Property Claims to secure a fair settlement that covers the full cost of rebuilding your property and replacing your items. We’ll provide a comprehensive report to your insurance company, arrange temporary accommodation for you, and restore your property. You’ll only be responsible for covering the insurance excess.

Contact All Property Claims today for expert guidance through your fire damage claim assessment. We’ll work with your insurance provider while you focus on what matters most.