In the UK, many of our homes are vulnerable to the natural elements, where water can pose a threat in a variety of different forms. Some of us reside by the coast or near fast flowing rivers, whilst other properties can be subjected to powerful storms, or damp rising up from the earth. In all of these cases, water can cause serious harm to a property, necessitating costly repairs to rectify the damage.

That’s why it’s so important to understand what’s covered by your home insurance policy when it comes to water damage. There’s nothing worse than going to make a claim only to find that your insurer is not willing to pay for the repair costs, leaving you in a perilous financial situation.

Read on to find out more about what kinds of water damage may be covered by your insurance policy, so you can prepare accordingly.

Key Causes of Water Damage

Water damage can arise in a number of different ways, where understanding these root causes is the first stage in defending your property.

Some origins of water damage include:

- Appliance Leaks – Many appliances and plumbing systems transport water around our homes, so they can cause serious damage if there is a malfunction.

- Flooding – The UK is surrounded by water, where flooding can arise in coastal areas, as well as from rivers and leaking sewage systems.

- Storms – As a result of a particularly severe storm, some properties may experience basement seepage, roof leaks, or exterior property damage.

- Drainage Issues – Sometimes, structural issues and improper drainage can lead to water damage, where this can impact foundations and property crawl space.

Water Damage Issues That Are Usually Covered

Fortunately, most home insurance policies will cover common examples of water damage, so you can repair your property without compromising your finances.

Some claims that are likely to be accepted include:

Storm Damage Claims

You may need to make a storm damage claim if your property has been harmed during particularly extreme weather. This could include high winds and heavy rainfall, which can cause damage to a roof or other exterior elements.

Typically, insurers will provide cover for storm damage, but this may be limited to external claims, with only some policies covering internal damage on top of this.

It can also be difficult to prove that the damage has arisen as the result of a storm, rather than due to poor maintenance. With expert advice and representation from All Property Claims, you can increase the likelihood of receiving a payment.

Gutter Overflow Claims

Damage to your property can occur if your drainage or gutter becomes clogged with debris. This can lead to water overflow, which may harm your drainage system in addition to wetting your walls and flooring.

With the help of a claims expert, you can ensure that you receive a payout for a gutter overflow claim, where our team can help you to provide photographic evidence and information concerning contaminated areas.

Flood Damage Claims

Flooding is an increasingly common cause of property damage, where many insurance policies will account for this eventuality. However, you may find that your insurer is looking to cut costs when it comes to paying, potentially withholding payment for a full strip-out.

With All Property Claims advocating for your best interests, you can ensure that your property is repaired to the highest standards. This means that everything will be properly dried out and replaced as necessary.

Water Damaged Walls

Water damaged walls can arise in your home for a number of reasons, whether this is caused by a burst pipe or by interior flooding. If this has occurred, then you can make an escape of water claim on your insurance, in order to cover the cost of repairs.

With the help of All Property Claims, you can ensure that the root cause of the issue is addressed as soon as possible. We’ll moisture map the affected areas and dry out your surfaces using specialist equipment, helping you to control the spread of water.

Pipe Leak Claims

Leaking pipes are another major cause of water damage in commercial and domestic properties. You may be able to make a claim for the cost of tracing and repairing the leak, helping to keep expenses to a minimum.

With the support of a claims expert, you can ensure that this repair and investigative work is fully covered, so you can expose the source of the problem and intervene quickly, without worrying about steep costs.

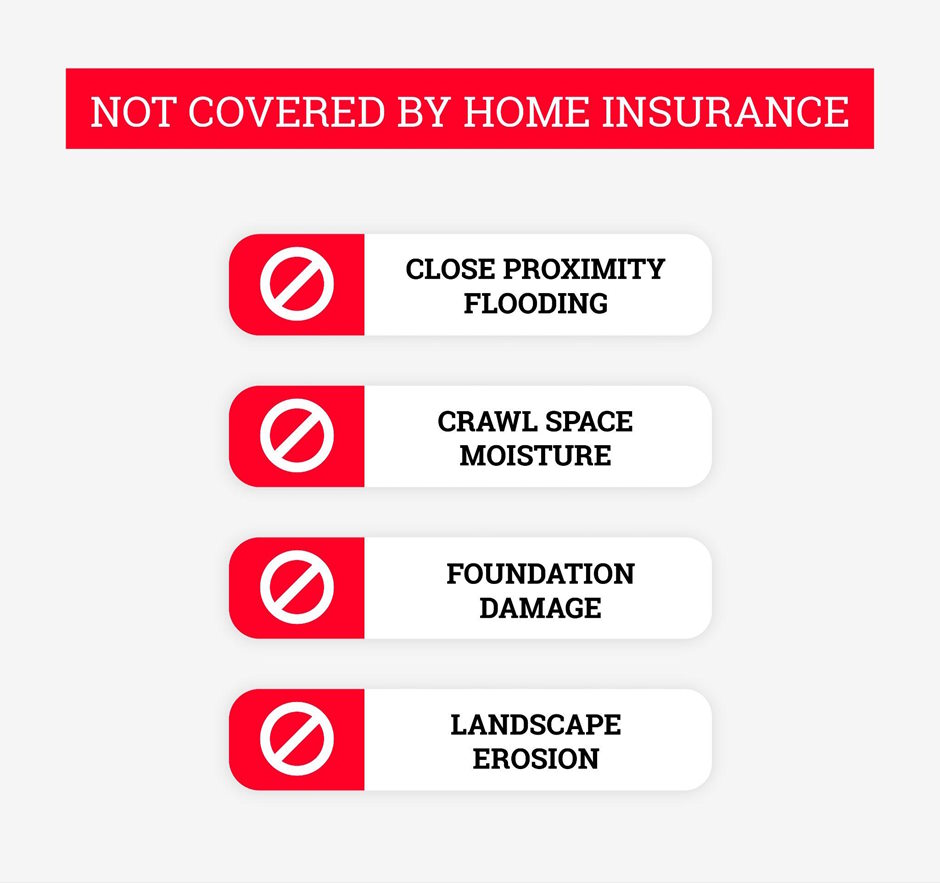

Damage That May Not Be Covered

Unfortunately, there are some forms of water damage that may not be covered by your insurer. It is important to be aware of these caveats to save you time and hassle if a specific issue does arrive, where you should always check your policy details carefully before signing.

Some types of damage that may not be covered include:

Close Proximity Flooding

Whilst some properties will receive insurance cover for flooding, this does depend on the risk level in the area. High risk flood zones may require specialist insurance coverage, especially if the property has flooded in recent years.

Some insurers will ask you to state the specific distance between your property and nearby coastal or river areas, where it is essential that you make an accurate disclosure in this case.

Crawl Space Moisture

The crawl space in your home can accumulate moisture over time, potentially due to poor ventilation. As a result, you may experience water damage and mould growth throughout your property.

Typically, this kind of issue would develop over a long period of time, meaning it is unlikely to be covered by your home insurance policy.

Foundation Damage

If your foundations are damaged, then the structural integrity of your property could be undermined, leading to a series of issues. This can occur due to poor drainage or water pooling around the building’s foundations.

Although this issue can be serious and costly to repair, it will be difficult to make a home insurance claim in this instance. This is because the problem takes a long time to develop, and is not caused by a specific insurable event.

Landscape Erosion

Equally, issues such as landscape erosion will be considered in a similar fashion. If poor drainage has led to soil erosion or sink holes around your building, then this can lead to infrastructure damage.

Unfortunately, as this is also a prolonged defect that occurs over an extended period of time, it is unlikely that you will be able to make a claim.

APC: Supporting Your Water Damage Insurance Claim

If you’re dealing with property damage and need to make a claim, then work with our team today. You have a right to qualified representation when dealing with your insurer, where we’ll negotiate on your behalf to ensure that you receive what you deserve.

Whether you’re looking to make a water damage insurance claim, or you have questions about your home insurance for flooding, then get in touch today. We can help to ensure that your water or flood damage claim is a success.