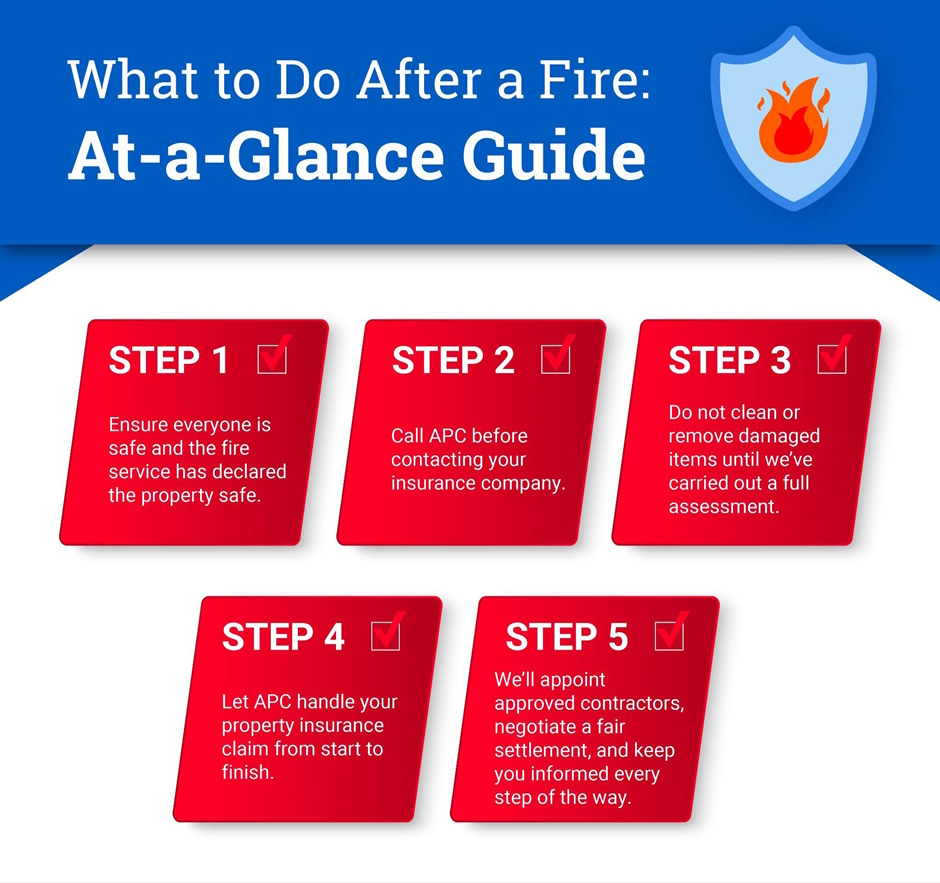

When your home suffers from serious damage, particularly something as traumatic as a house fire, your first instinct is to act fast. But making the wrong move during the property insurance claims process can lead to delayed repairs, reduced payouts, and an overwhelming amount of stress.

Here at All Property Claims, we’ve seen first-hand how easy it is for homeowners to make errors, especially when fire damage is involved. Our guide is here to walk you through the top five mistakes people make during property insurance claims, and how to get it right with expert help.

1. Calling the Insurance Company First

It might seem logical to phone your insurer as soon as the fire is out, but this can backfire. Insurers are ultimately looking to settle claims at the lowest reasonable cost. Once they’re in control of the process, homeowners often feel rushed, under-informed, and powerless.

How To Get It Right

Contact a claims management expert like APC first. We work on your side, not the insurer’s, managing the entire process from assessment to negotiation and reinstatement.

2. Failing to Fully Document Fire Damage

After a fire, it’s easy to forget details or start cleaning up before taking photos. Unfortunately, poor documentation can weaken your claim. Hidden issues like smoke contamination in insulation or wiring are also often missed.

How To Get It Right

Let APC professionally assess and document the damage. We will photograph every affected area, create a full inventory, and ensure even secondary damage is recorded.

3. Accepting the First Settlement Offer

In a rush to move on, many homeowners will accept the first figure offered. These initial offers are often based on minimal repair work and may not reflect the full cost of reinstating your home and possessions.

How To Get It Right

APC has decades of experience in insurance claims management and understands how to challenge under-valued offers. We fight for fair compensation based on industry benchmarks and actual rebuild costs.

Starting DIY Repairs Too Early

It’s tempting to start clearing soot and repainting walls straight away, but this can actually interfere with the claims process. Worse still, it may void parts of your insurance cover.

How To Get It Right

Always wait for an approved assessment. APC ensures your property is fully inspected before any work begins. We also arrange vetted, insurance-approved contractors to carry out all restoration work for you.

Misunderstanding Your Policy Cover

Fire damage claims can be complex, and many people assume their policy covers “everything”. But exclusions, excess clauses, and underinsurance are common stumbling blocks.

How To Get It Right

APC carefully reviews your policy documents and highlights any limits, conditions, or exclusions. We’ll also help you understand what you are entitled to claim.

Let APC Protect Your Interests

Dealing with property damage, especially from a fire, is distressing enough. Don’t let mistakes in the claims process add to the pain. Get in touch with us today to learn more about how we can help you.