Malicious Damage Insurance Claim Support That Ensures a Fair Outcome for You

If your property has suffered from malicious damage, we understand that dealing with insurance claims and repairs can be a daunting process.

Whether it’s a small or a larger-scale incident, our expert team at All Property Claims is here to guide you through every step of the malicious damage insurance claim process. We work to make sure that you receive the compensation you deserve and manage the restoration of your property, so you can focus on what matters most: getting your business or home back to normal.

Why Choose All Property Claims?

Expert Guidance, Every Step of the Way – We specialise in malicious damage insurance claims and repairs, offering a seamless claims process. Our experienced team handles everything from the initial assessment to the final restoration.

Personalised Attention

Every claim is different, and we tailor our services to meet the needs of your situation, making sure to minimise the stress of your malicious damage claim.

Free Service When We Arrange the Approved Repairs

Our claim support service is provided at no cost to you, provided we are authorised to arrange the approved repairs once your claim is settled.

Regulated by the FCA

We are regulated by the Financial Conduct Authority (FCA) and have permissions to negotiate with insurers to ensure they perform fairly in accordance with the insurance contract.

Our Property Damage Insurance Claims Process

Damage Assessment – Comprehensive Survey and Documentation

Our team will attend your property promptly to conduct a thorough survey of the damage. We take detailed notes, measure the extent of the destruction, and capture high-quality photographic evidence.

Emergency Repairs – Immediate Action to Secure Your Property

Once we have assessed the damage, we move quickly to implement emergency repairs. Whether it’s securing broken doors, replacing locks, or boarding up windows, we take all necessary actions to prevent further damage to your property.

Claims Management – Expert Preparation and Submission

We work carefully to make sure that your claim is prepared correctly, meets all the necessary insurer requirements, and is submitted in a timely manner. Our attention to detail means that your claim is as strong as possible, improving the chances of a quick and favourable outcome.

Negotiation – Advocating for a Fair Settlement

Once your claim is submitted, our team takes over the negotiation process with your insurer and any appointed loss adjusters. We handle all communication and advocate on your behalf, so you don’t have to deal with the hassle during an already stressful time.

Permanent Restoration – Full Repairs to Restore Your Property

Once your claim is approved and the settlement is finalised, we coordinate the full restoration of your property.

Customer Testimonials

Lara – October 2025

★★★★★

All Property Claims is unlike any other company I’ve used before. Their support is second to none, especially when dealing with insurance issues. I’ve never regretted using them; they’ve been absolutely invaluable. Their tradespeople are professional, efficient, and complete work…

Eloise – September 2025

★★★★★

I can’t thank All Property Claims enough for their outstanding service. After experiencing a devastating flood, they guided me seamlessly from the chaos to resolution. Their expertise, dedication, and support made all the difference in restoring normalcy. Highly recommend!

Matteo B – April 2025

★★★★★

Allpropertyclaims was instrumental in ensuring the damage from a leak was properly assessed, investigated and repaired. They were really supportive throughout the lengthy process of dealing with the insurance, and took the lead in dealing with a particularly challenging…

Our Team

Our team consists of skilled claim specialists who take pride in supporting clients through every stage of a malicious damage insurance claim. From the first inspection to the final repair, we ensure that each client receives expert attention and care throughout the claims process.

Abhijeet Singh

Claims Manager

Matthew Farthing

Claims Manager

Steve Guest

Surveyor

Proven Results for Property Owners

Read our case studies to understand how we approach of our clients varying needs.

Vandalism by Departing Tenants

Incident Summary

At the end of a tenancy, the outgoing tenants caused deliberate damage to a rental flat, targeting the front bay window and the bedroom door frame. The landlord discovered the vandalism just days before a new tenant was due to move in. The extent of the malicious damage required urgent repairs, including window replacement, plaster work and internal joinery restoration.

Client Concerns

The landlord had already signed a new tenancy agreement and was relying on uninterrupted rental income to meet mortgage payments. She was worried that the incoming tenant might refuse to move in or request a rent reduction while repairs were carried out. With the risk of rental income loss and further property deterioration, she needed a fast and well-managed malicious damage insurance claim.

How APC Managed The Claim

Our team acted quickly to secure the property and start the claims process. The damaged bay window was boarded up immediately to prevent further harm and maintain safety. APC collected detailed photographic evidence and submitted a comprehensive malicious damage insurance claim to the landlord’s insurer, including a copy of the new tenancy agreement to demonstrate the financial risk associated with the delay.

When the insurer appointed a loss adjuster, APC’s surveyor attended the site meeting to discuss the damage in detail and agree on the necessary repair scope. APC negotiated on the landlord’s behalf to ensure the settlement included not only the full cost of reinstatement works but also payment for loss of rent during the repair period, protecting the landlord from financial hardship.

Once approved, repairs progressed swiftly. The window was replaced, internal plaster damage beneath the bay was repaired, and the bedroom door frame and surrounding woodwork were restored before redecorating the entire room.

Before:

Work In Progress:

After:

Damage to Communal Areas

Incident Summary

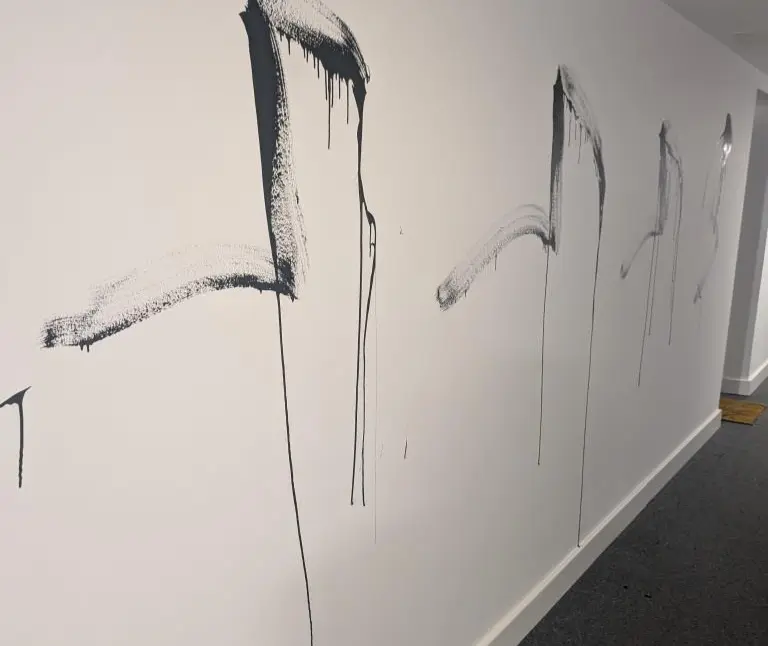

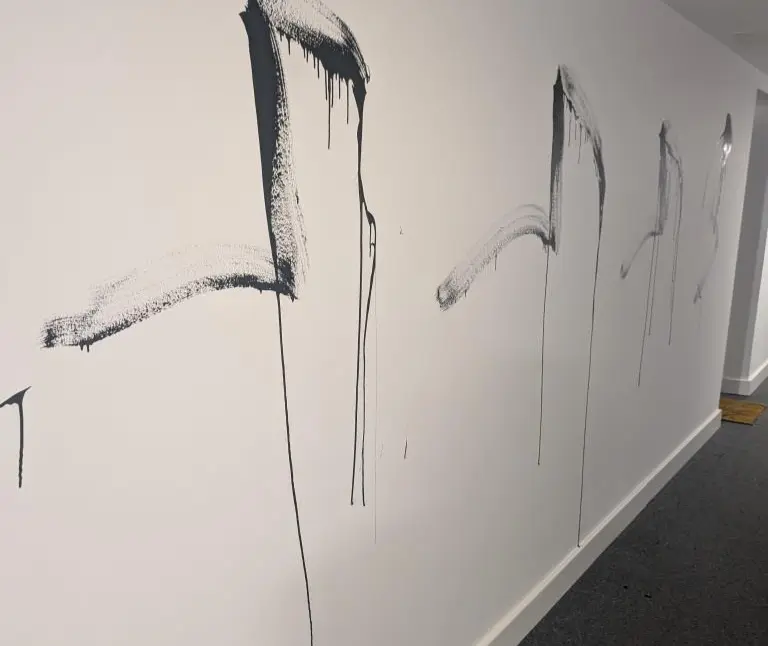

Late one evening, vandals entered the communal areas of a block of flats and sprayed graffiti across internal walls, ceilings and carpets. The incident affected shared hallways and posed both aesthetic and reputational concerns for the building’s freeholder, who needed the damage addressed quickly to maintain resident confidence. The nature of the incident qualified for a malicious damage insurance claim.

Client Concerns

The freeholder was worried that the insurer might reject the claim because the building’s CCTV system was not functioning at the time of the attack, making it unlikely that the vandals would be identified. Residents were also pressuring for urgent removal of the graffiti, as the damage was visible throughout the communal areas. The freeholder reported the incident to the police and appointed APC immediately to manage the insurance claim and help restore the property.

How APC Managed the Claim

APC submitted a malicious damage insurance claim and presented clear evidence of the vandalism to the insurer. We negotiated for the policy to cover specialist graffiti removal, electrical repairs to areas affected by the spray damage, and full redecoration of the communal spaces. The claim was accepted, enabling the freeholder to proceed with professional restoration works and return the building to its original condition without financial loss.

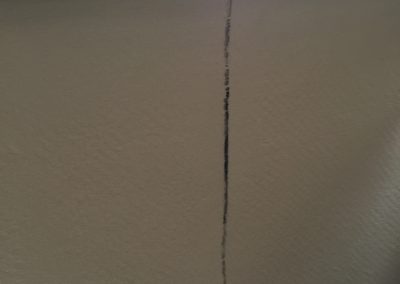

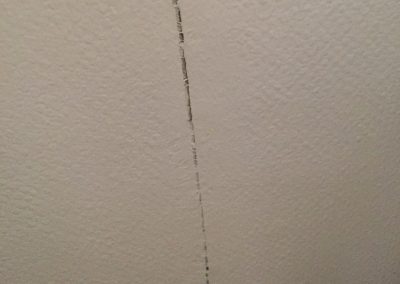

Before:

After:

Vandalism Damage

Incident Summary

A detached property was broken into through a side door while the owner was away on holiday. The intruders caused significant damage to the doorway and the surrounding plasterwork, leaving the entrance structurally compromised and requiring urgent reinstatement. The circumstances were suitable for a malicious damage insurance claim.

Client Concerns

The homeowner was concerned that the insurer might reject the claim because the property had been unoccupied during the break-in. They were unsure whether their policy would still respond, and they were anxious to secure repairs quickly so the property remained safe and protected from further loss.

How APC Managed the Claim

APC attended the property to inspect and photograph the damage, then carried out a detailed review of the client’s insurance policy. We confirmed that the claim remained valid because the property had not been unoccupied for more than 30 consecutive days. APC submitted the claim with supporting evidence, including the crime reference number, and recommended a full scope of reinstatement works, covering door replacement, plaster repairs and redecoration throughout the hallway, stairwell and landing.

After meeting with the insurer’s appointed loss adjuster and negotiating the scope of works, the full repair costs were approved. Restoration work began the same week and was completed within seven days, allowing the homeowner to return to a fully reinstated property without unnecessary disruption or financial loss.

Photos:

Vandalism by Departing Tenants

Damage to Communal Areas

Vandalism Damage

Case Study: Vandalism by Departing Tenants

Incident Summary

At the end of a tenancy, the outgoing tenants caused deliberate damage to a rental flat, targeting the front bay window and the bedroom door frame. The landlord discovered the vandalism just days before a new tenant was due to move in. The extent of the malicious damage required urgent repairs, including window replacement, plaster work and internal joinery restoration.

Client Concerns

The landlord had already signed a new tenancy agreement and was relying on uninterrupted rental income to meet mortgage payments. She was worried that the incoming tenant might refuse to move in or request a rent reduction while repairs were carried out. With the risk of rental income loss and further property deterioration, she needed a fast and well-managed malicious damage insurance claim.

How APC Managed The Claim

Our team acted quickly to secure the property and start the claims process. The damaged bay window was boarded up immediately to prevent further harm and maintain safety. APC collected detailed photographic evidence and submitted a comprehensive malicious damage insurance claim to the landlord’s insurer, including a copy of the new tenancy agreement to demonstrate the financial risk associated with the delay.

When the insurer appointed a loss adjuster, APC’s surveyor attended the site meeting to discuss the damage in detail and agree on the necessary repair scope. APC negotiated on the landlord’s behalf to ensure the settlement included not only the full cost of reinstatement works but also payment for loss of rent during the repair period, protecting the landlord from financial hardship.

Once approved, repairs progressed swiftly. The window was replaced, internal plaster damage beneath the bay was repaired, and the bedroom door frame and surrounding woodwork were restored before redecorating the entire room.

Damage to Communal Areas in a block of apartments

Incident Summary

Late one evening, vandals entered the communal areas of a block of flats and sprayed graffiti across internal walls, ceilings and carpets. The incident affected shared hallways and posed both aesthetic and reputational concerns for the building’s freeholder, who needed the damage addressed quickly to maintain resident confidence. The nature of the incident qualified for a malicious damage insurance claim.

Client Concerns

The freeholder was worried that the insurer might reject the claim because the building’s CCTV system was not functioning at the time of the attack, making it unlikely that the vandals would be identified. Residents were also pressuring for urgent removal of the graffiti, as the damage was visible throughout the communal areas. The freeholder reported the incident to the police and appointed APC immediately to manage the insurance claim and help restore the property.

How APC Managed the Claim

APC submitted a malicious damage insurance claim and presented clear evidence of the vandalism to the insurer. We negotiated for the policy to cover specialist graffiti removal, electrical repairs to areas affected by the spray damage, and full redecoration of the communal spaces. The claim was accepted, enabling the freeholder to proceed with professional restoration works and return the building to its original condition without financial loss.

Case Study: Vandalism Damage

Incident Summary

A detached property was broken into through a side door while the owner was away on holiday. The intruders caused significant damage to the doorway and the surrounding plasterwork, leaving the entrance structurally compromised and requiring urgent reinstatement. The circumstances were suitable for a malicious damage insurance claim.

Client Concerns

The homeowner was concerned that the insurer might reject the claim because the property had been unoccupied during the break-in. They were unsure whether their policy would still respond, and they were anxious to secure repairs quickly so the property remained safe and protected from further loss.

How APC Managed the Claim

APC attended the property to inspect and photograph the damage, then carried out a detailed review of the client’s insurance policy. We confirmed that the claim remained valid because the property had not been unoccupied for more than 30 consecutive days. APC submitted the claim with supporting evidence, including the crime reference number, and recommended a full scope of reinstatement works, covering door replacement, plaster repairs and redecoration throughout the hallway, stairwell and landing.

After meeting with the insurer’s appointed loss adjuster and negotiating the scope of works, the full repair costs were approved. Restoration work began the same week and was completed within seven days, allowing the homeowner to return to a fully reinstated property without unnecessary disruption or financial loss.

Frequently Asked Questions

We know insurance claims can feel overwhelming, especially if it’s your first time dealing with one. That’s why we’ve put together this FAQ section – to answer common questions, explain the process in plain English, and show how our expertise makes the journey smoother and less stressful for you.

Is malicious damage covered by insurance?

Yes, most policies cover deliberate damage caused by a third party, such as vandalism or break-ins.

However, exclusions can apply if the person causing the damage was lawfully in your home, so policy terms must be checked.

What counts as malicious damage?

Malicious damage is intentional harm caused by someone acting deliberately to damage your property, such as breaking windows or vandalism.

It must be a purposeful act – not accidental – and usually caused by someone outside your household.

What insurance covers malicious damage?

Malicious damage is typically covered under standard home insurance or landlord insurance as part of the buildings and contents sections.

Some policies require an optional add-on, so it’s important to check your specific cover and any exclusions.

How serious is malicious damage to property?

Malicious damage can range from minor cosmetic harm to significant structural or security issues that require urgent repair.

Insurers take it seriously because it is intentional damage, often needing investigation and clear evidence to support a claim.