None of us ever think we’ll be the ones affected by a natural or freak disaster affecting our home, and yet disaster strikes when you least expect it, with the potential to affect anyone.

Whether a storm hits or there’s a flash flood warning in your area, there’s often little you can do to prepare for such events – there’s certainly nothing you can do to control them, as they often occur with little to no warning at all. And yet, the effects of such disasters can have a devastating impact on your property.

So, what are you supposed to do in this situation? We understand this can be both an upsetting and overwhelming situation to find yourself in, which is why we’ve put together this guide to help you in navigating such scenarios. Keep reading to learn what steps you should take in the event that a natural disaster impacts your home.

What Disasters Could Affect Your Home?

Before we jump into what to do post-disaster, let us first discuss the potential disasters themselves. There are many different factors that have the potential to cause property damage to your home, but in this case, we’re referring to natural disasters – environmental causes that are completely out of your control.

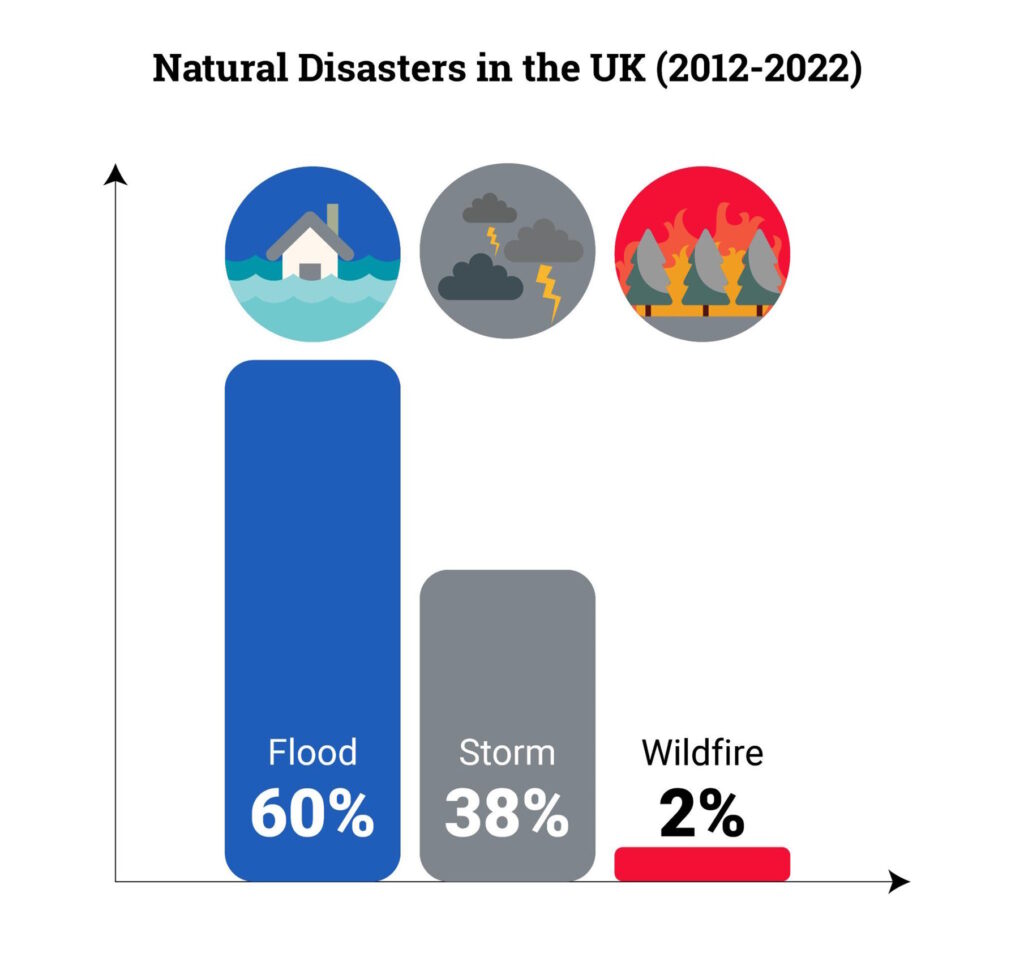

Which natural disasters, then, might you experience in the UK?

Flood

Flooding is the most common of weather-related natural disasters to occur in the UK – one that’s especially likely to impact you if you live near a body of water, such as a river, lake or the sea.

There are various reasons for flooding, such as waves coming on shore, snow melting too fast or dams or levees breaking; however, the (arguably) most common reason for flooding is heavy rainfall causing water to overflow onto land that is normally dry. This poses even more of an issue after periods of drought, as the land is often dryer and drainage is poor.

On top of this, flash flooding also commonly occurs. The main difference between flooding and flash flooding is the duration at which each occurs; flooding is considered to be a longer term event, one that can last days or even weeks, whilst flash flooding is caused by sudden, excessive rainfall that occurs in a short period of time – often a few hours.

It’s this short timeframe that makes flash flooding so devastating, as it tends to occur with little warning and leaves you with no time to prepare.

Storm

The UK has seen a rise in storms over recent years – particularly in named storms. This is important to distinguish, as a storm is given a name when it has the potential to cause significant damage to homes and infrastructure, disruption to travel and a risk to lives, resulting in an amber or red weather warning being issued by the Met Office.

In the UK, the official storm season begins at the end of the summer in September each year, then ends in August the following year. In the current storm season, the UK has already experienced 11 storms, 10 of which occurred by January this year.

Whilst the speculation of whether storms will become more frequent in the UK is still a subject of ongoing scientific research, evidence does suggest that as global warming continues, storms with heavy rain are likely to become more common and their effects more intense.

Storms can cause various degrees of damage to your property, for example falling trees or loose debris may physically impact your property, whilst storms can also cause water damage and may also pose an electrical hazard.

Fire

Whilst wildfires aren’t as common in the UK as they are in other parts of the world, they can still occur. In fact, the reason that many do break out is actually due to human activity – albeit unintentional.

With the increase of climate change over recent years, conditions in the UK are becoming more favourable for wildfires to thrive; prolonged periods of hotter temperatures means drier conditions and vegetation – just what a fire needs to spread.

As for the cause of fires, hot weather alone isn’t likely to be to blame. Rather, there is often another factor at play, such as lightning strikes or human negligence (e.g. discarded cigarettes, campfires or disposable barbecues that have not been properly extinguished).

If you live in an area surrounded by lots of dry vegetation, such as heather, gorse or peat, then your property may be more at risk of being affected by a fire in the summer months.

The Steps to Take Following a Disaster

If you are ever affected by any of the aforementioned natural disasters, then it can be daunting trying to navigate the next steps, especially if you don’t know where to start. That’s why we’ve figured it out for you. Keep reading below to see the process you should follow in order to get your property back in tip top shape as quickly as possible.

Safety First

The most important thing for you to prioritise first and foremost is the safety of yourself and your family.

Whilst you should be proactive when it comes to filing a home insurance claim following a natural disaster damaging your property, it’s more important to first respond to any emergencies and ensure that everyone in your property is both safe and not exposed to further potential harm.

This involves making sure everyone in your property is accounted for and calling the emergency services if anyone is injured or in danger. Depending on the type of damage, you may want to call the fire brigade if your house is on fire or turn off your electricity if your property is being flooded (if it is safe to do so) and leave the property to get to safety.

Identify the Damage

Once you’ve ensured your own safety and the safety of any occupants in your home, the next step is to assess the safety of your property, so that you can then assess the damage within.

After taking the initial steps to get the situation under control, next it’s time to assess the state of your property and identify what damage has been done. Of course, your safety is still imperative, so you should not reenter your property if it isn’t safe to do so.

Whilst you’re outside, check for structural damage, electrical hazards or any other potential risks. This is also the perfect opportunity to take exterior pictures of any apparent damage to your property. If you do suspect there is immediate danger, then you should contact the appropriate professionals to resolve this before reentering.

If your property is safe to reenter, do so with caution. You can then assess the damage, making notes of and recording evidence of the damage to your property and belongings. Consider the following:

- Where is the major damage located?

- Is any part of your home exposed to further potential damage (e.g. a hole in the roof, broken windows)?

- What type of damage has occurred (e.g. water damaged walls, smoke damage)?

- What, if any, possessions have been damaged and how much did these cost?

Make sure you take plenty of photographs, as these will make for important supporting evidence when you do make your claim. These will also be helpful for distinguishing whether further damage is caused between the time of the initial damage and when the damage is assessed by a third party.

Call APC

Once you’ve done a preliminary check of the damage, you may think the next step to take is to contact your insurer. Whilst it’s important to make a claim as quickly as possible after incurring property damage, you should not contact your insurer directly.

Instead, you should instruct us here at All Property Claims to handle your claim for you. The reason you shouldn’t go directly to your insurer is because it isn’t in their best interest to ensure you get the most available from your claim that you’re entitled to, since this involves them having to pay out more of their money.

Here at All Property Claims, we have extensive experience dealing with insurance companies and operate with our clients’ – your – best interest in mind.

By calling us, we will collect your insurer’s details and arrange for one of our surveyors to visit your property in order to record the extent of the damage following the disaster, after which a report and detailed quote will be drawn up and sent to your insurer within 48 hours.

It’s important to note that, before calling us, you shouldn’t try to fix any of the damage yourself. Whilst you may think it helpful to start cleaning up your property, if you do so before sufficient evidence has been documented, this may negatively impact your claim, as it’s important that your insurers are clear on exactly what damage has occurred and the state your property is in.

Once we’ve been in touch with your insurer, they will send an independent loss adjuster to then meet with our surveyor at your property in order to agree on the costs required to reinstate your property to the condition it was in before the damage occurred.

As soon as these costs are agreed with your insurer, we’ll begin restoration work within 48 hours, ensuring everything is back the way it was before. All of this is handled on your behalf, with no involvement required on your end, thus allowing you to focus on more important things during such a stressful time – all you’ll have to do other than calling us is cover the excess stated on your policy!

Professional Property Insurance Claims Management

If you ever find yourself needing to make an insurance claim following damage to your property, then be sure to reach out to us here at All Property Claims.

With extensive experience with insurance claims management, we help to liaise with your insurer on your behalf and ensure you get the most you’re entitled to out of your claim, whilst taking the stress of dealing with your insurers directly off your shoulders.

Get in touch with us today to discuss how we can help you.