Water leaks can be a nightmare for homeowners which can cause a great deal of damage to your property, and sometimes even lead to costly repairs. If you’re facing water damage and wondering whether you can claim on your home insurance, this guide will walk you through everything you need to know to make a successful claim.

When Should You Claim Home Insurance for Water Damage?

Not all water damage warrants a claim on your home insurance, so it’s important to know when it’s appropriate to claim and when it might not be worth the effort.

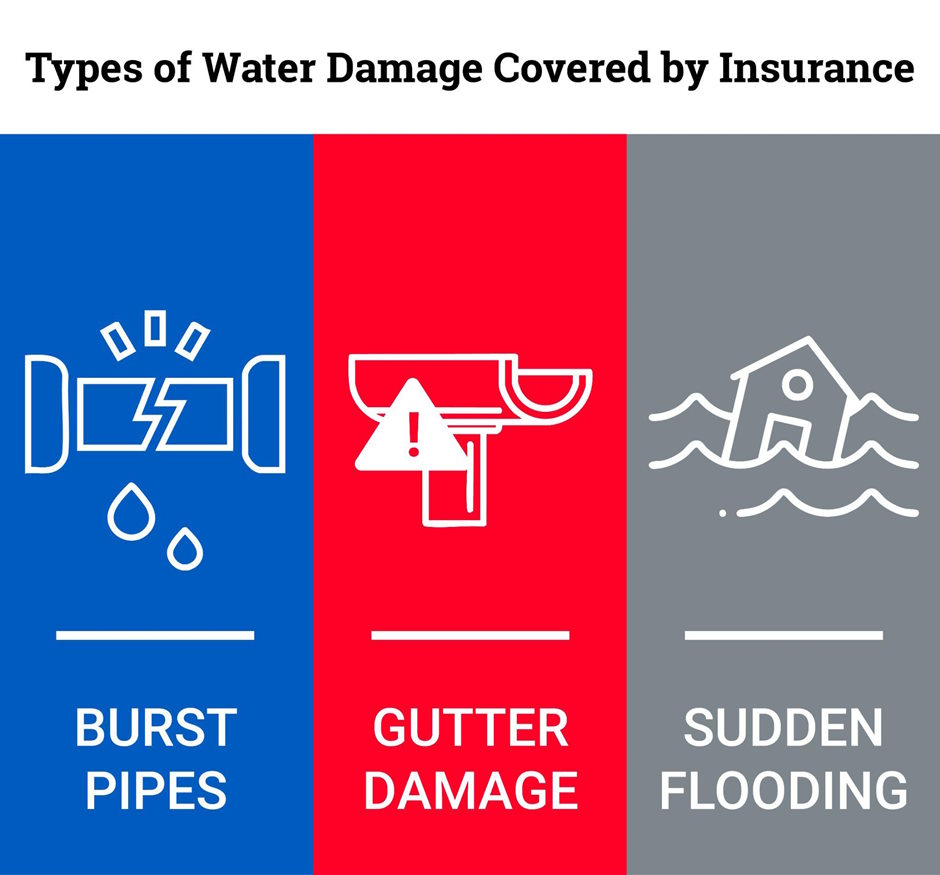

Sudden and Accidental Damage

If the water leak was unexpected and caused by something like a burst pipe, your home insurance policy is likely to cover the damage.

Damage from Natural Disasters

Water damage from storms, heavy rains or gutter damage caused by debris may also be covered under your policy.

Exclusions to Note

Insurers often exclude damage resulting from negligence, like failing to fix a leaking pipe or maintain gutters. Wear and tear is generally not covered, so it’s a good idea to review your policy terms.

If you’re unsure whether your situation qualifies, professionals like All Property Claims can review your policy and determine your eligibility.

What Documentation Do You Need for a Claim?

To make a strong water damage insurance claim, having thorough documentation to hand is essential. Insurers need proof of the damage, how it happened and the steps you’ve taken to address it. Here’s what you’ll need:

Photographic Evidence

Take clear photos of the damage immediately after discovering it. Include images of the source of the leak, affected areas and any belongings damaged.

Repair and Maintenance Records

If the damage was caused by an issue you previously tried to fix, having receipts or records of maintenance work will strengthen your claim.

Professional Assessments

A surveyor’s or contractor’s report detailing the cause and extent of the damage can also be invaluable. This is where All Property Claims steps in, providing detailed assessments insurers can’t ignore.

Itemised Lists

Create a list of damaged items, including their value and purchase receipts if available.

Proof of Insurance Policy Coverage

Keep your policy documents on hand to demonstrate the areas of coverage relevant to your claim.

Steps to Make a Successful Insurance Claim

1. Act Quickly

Time is of the essence, so notify your insurer as soon as you discover the damage. Delaying the claim could lead to complications or even denial.

2. Mitigate Further Damage

Insurers expect homeowners to take reasonable steps to prevent additional damage. For example, if a pipe bursts, shut off the water supply and move belongings away from affected areas.

3. Review Your Insurance Policy

Go through your policy to understand what is and isn’t covered. If you’re unsure, consult a claims expert like All Property Claims, who can interpret the fine print for you.

4. Hire a Claims Specialist

Going through the claims process can be overwhelming, so don’t go it alone. A specialist can assess the damage, gather the necessary documents and liaise directly with your insurer to make sure that you get the compensation you deserve.

5. Submit Your Claim

Provide all required documentation and be prepared to answer questions from the insurer. A well-prepared claim increases the likelihood of approval.

6. Follow Up

Don’t hesitate to follow up with your insurer if the process seems to stall. Remember: persistence often pays off.

Common Pitfalls to Avoid

If you’re going through the process of filing a water damage insurance claim for the first time, it can be complicated and as a result, easy to encounter pitfalls. To increase the likelihood of your claim being accepted, here are some of the biggest mistakes to avoid.

Failing to Document Thoroughly

Inadequate documentation is one of the most common reasons for claim denials. Be meticulous in capturing evidence and keeping records.

Waiting Too Long to Report Damage

Many policies require you to report damage within a specific time frame. Missing this window could invalidate your claim.

Neglecting Maintenance

If your insurer determines that the damage resulted from poor maintenance, they may reject your claim. Regular checks and gutter cleanings can prevent issues like gutter damage from getting worse.

How All Property Claims Can Help

Looking for a home insurance claims company to guide you through claiming home insurance for water damage? All Property Claims might just be the right service for you. Here are just a few reasons why you should work with us.

Damage Assessment

Our experienced surveyors assess the full extent of the damage, meaning you can rest assured that no issue is overlooked.

Policy Review

We’ll review your insurance policy to identify what is covered, helping you build a solid case for your claim.

Liaising with Insurers

We act as the intermediary between you and your insurer, simplifying communication and making sure that your claim is handled efficiently.

Comprehensive Repairs

Once your claim is approved, we coordinate repairs to restore your property to its original state. Our trusted network of contractors guarantee high-quality results. Let us handle the heavy lifting so you can focus on getting your home back in order.

FAQs About Water Damage Insurance Claims

Can I claim for gutter damage caused by storms?

Yes, many home insurance policies cover damage caused by natural events, including storms and heavy rainfall. Make sure that you have evidence of the event and the resulting damage.

What if my insurer denies my claim?

If your claim is denied, All Property Claims can help you challenge the decision by gathering additional evidence and negotiating with your insurer.

Does my policy cover gradual water damage?

Most policies exclude gradual damage caused by wear and tear or lack of maintenance. However, sudden incidents like a burst pipe are typically covered.

Count On Us for Help with Home Insurance Claims

Dealing with water damage can be stressful, but knowing how to navigate the claims process and having the right support can make a significant difference. Whether you’re claiming for a burst pipe, gutter damage or water damage from a storm, preparation and documentation are key to success.

At All Property Claims, we’re committed to helping homeowners navigate this challenging process. From assessing damage to negotiating with insurers, we’re here to help you get the settlement you deserve. Get in touch with our experienced home insurance claim team to get started.