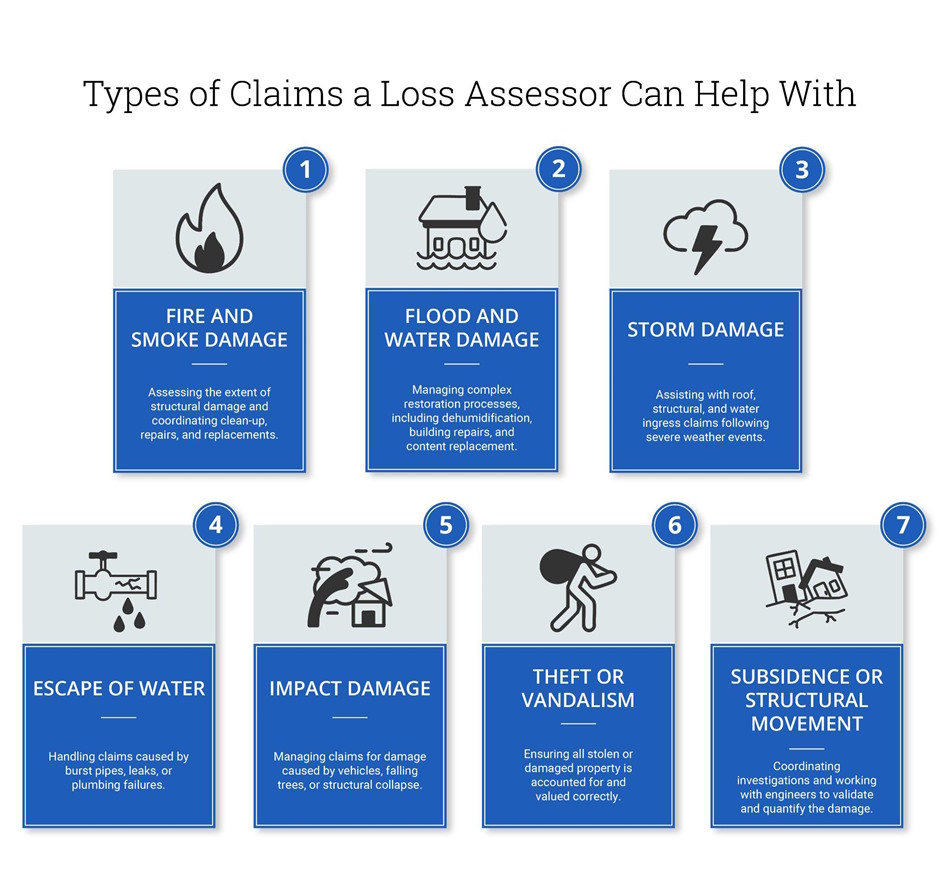

When your home or business suffers damage from events such as fire, flooding, storms, or escape of water, the aftermath can be overwhelming. Dealing with your insurer, assessing the damage, and managing the claims process can quickly become complex and stressful. This is where a loss assessor steps in – representing you, the policyholder, to ensure you receive the fair settlement you are entitled to.

In this article, we’ll explore the vital role of a loss assessor in property insurance claims, how they differ from loss adjusters, and why their expertise is invaluable when navigating the claims process.

What Is a Loss Assessor?

A loss assessor is an independent professional who acts exclusively on behalf of the policyholder during an insurance claim. Their role is to manage every aspect of the claim, from assessing the damage to negotiating directly with your insurer, to ensure you achieve the best possible outcome.

Unlike an insurance assessor or loss adjuster, who is employed by the insurance company to protect their interests, a loss assessor represents you. They interpret your policy, prepare the necessary documentation, and negotiate a settlement that accurately reflects your loss.

For many property owners, the claims process can be daunting. Insurance policies are often filled with complex terms and conditions that can be difficult to interpret, particularly under stressful circumstances. A loss assessor provides clarity, handling the technical details so you can focus on recovery and restoration.

The Difference Between a Loss Assessor and a Loss Adjuster

One of the most common misunderstandings in property claims management is the difference between a loss assessor and a loss adjuster. While both are involved in the insurance claim process, their roles and who they represent are fundamentally different.

- Loss Adjuster (or Insurance Assessor):

Appointed by your insurance company to assess the validity of your claim and determine the extent of the insurer’s liability. Their primary responsibility is to the insurer, ensuring that the claim is settled in accordance with the policy terms – often to minimise the insurer’s payout.

- Loss Assessor:

Appointed by the policyholder to handle the claim on their behalf. Their goal is to maximise your entitlement under the policy and to make sure all legitimate costs are included in the final settlement.

In essence, the insurance assessor protects the insurer’s interests, while the loss assessor protects yours.

Working with a professional loss assessor such as All Property Claims ensures that you have a qualified expert advocating for your rights throughout every stage of the claims process.

How a Loss Assessor Supports Property Insurance Claims

A loss assessor’s role covers every step of the property insurance claims journey – from the initial assessment to final settlement. Their involvement ensures that the claim is managed efficiently, fairly, and in line with your policy terms.

Initial Damage Assessment

The process begins with a full inspection of the affected property. The loss assessor will evaluate the extent of the damage, photograph the site, and record all losses. This information forms the basis of your claim and ensures that nothing is overlooked.

Policy Review and Interpretation

Insurance policies can be lengthy and complex. A loss assessor will carefully review your policy wording, identifying what you are covered for and clarifying any exclusions or special conditions. This ensures that your claim is presented correctly from the start.

Claim Preparation and Submission

Preparing a detailed, well-documented claim is essential to achieving a fair settlement. Your loss assessor will compile a full schedule of works, itemised repair costs, and supporting evidence before submitting the claim to your insurer.

Negotiation and Communication with Insurers

Once the claim is submitted, the loss assessor handles all communication and negotiation with the insurer and their appointed insurance surveyor or loss adjuster. They use their technical knowledge to ensure your losses are accurately valued and that settlement offers are fair.

Project Management and Restoration Oversight

Many loss assessors also assist in managing the reinstatement or repair works following approval of the claim. They can coordinate contractors, monitor progress, and ensure work meets industry standards – saving you time and stress.

Settlement and Aftercare

When the insurer agrees to the settlement, your loss assessor reviews the final offer to ensure it reflects your entitlement. They’ll continue to support you until the claim is fully resolved and your property is restored.

This end-to-end support is what makes hiring a loss assessor so valuable. It turns a potentially stressful and time-consuming process into one that’s managed professionally and efficiently on your behalf.

Why Appointing a Loss Assessor Is Beneficial

Appointing a professional loss assessor provides a wide range of benefits when handling property damage and insurance claims. With in-depth knowledge of policy wording, claims processes, and valuation methods, a loss assessor ensures your claim is accurately prepared, fully documented, and presented in a way that strengthens your position. Their expertise helps you navigate complex insurance terms confidently, avoiding costly delays or missed entitlements.

A loss assessor also saves you valuable time. Managing an insurance claim can be a lengthy and stressful process, especially while dealing with repairs or business disruption. By taking care of all correspondence, paperwork, and site inspections, they remove the administrative burden and keep the process moving efficiently.

Perhaps most importantly, a professional loss assessor works to maximise your settlement. Using their negotiation skills and industry insight, they ensure the final payout reflects the true extent of your losses rather than the insurer’s initial offer. This often leads to a fairer and more comprehensive outcome.

Beyond the financial benefits, working with a loss assessor significantly reduces stress during what is often a difficult and emotional period. They provide clear communication, reassurance, and support throughout every stage of the claim to ensure you receive the best possible result.

Working with All Property Claims

At All Property Claims, we specialise in property claims management across a wide range of residential and commercial insurance claims. Our experienced loss assessors and insurance surveyors work exclusively for policyholders – not insurance companies – ensuring you get the fair, full settlement you’re entitled to.

We provide:

- Comprehensive claim handling: From initial inspection to final settlement.

- Expert negotiation: Dealing directly with insurers and loss adjusters on your behalf.

- Qualified professionals: Our assessors and surveyors are fully trained and experienced in all aspects of property insurance claims.

- Nationwide coverage: Supporting homeowners, landlords, and businesses across the UK.

Whether your property has been affected by fire, flooding, storm damage, or any other insured event, our dedicated team will guide you through every step of the claims process with professionalism and care.

The Importance of Professional Property Claims Management

Managing an insurance claim on your own can often lead to delays, missed details, or reduced settlements. With All Property Claims, you have a team of industry experts ensuring your claim is handled efficiently, accurately, and fairly.

Our property claims management service ensures all damage is properly documented, repair costs are validated, and insurers are held accountable to policy terms. By acting as your single point of contact, we make the entire process smoother.

Get Expert Help with Your Property Insurance Claim

If you’re facing property damage and need help navigating the insurance process, don’t go through it alone. A loss assessor from All Property Claims can make all the difference – managing your claim, protecting your interests, and securing the settlement you deserve.

Contact All Property Claims today to speak with one of our experienced loss assessors and learn how we can help you with your property insurance claim.