If you are in the midst of a home insurance claim, you may be wondering how long the process will take to reach a resolution. The truth is, there is no definitive timeline, as the duration of a claim can vary greatly depending on a number of factors.

In this guide, we will walk you through the key stages of a home insurance claim, from reporting the damage to receiving approval, while exploring the various factors that can influence the timeline. By the end, you’ll have a clearer understanding of what to expect and how to manage the process more effectively.

An Overview Of The Home Insurance Claims Process

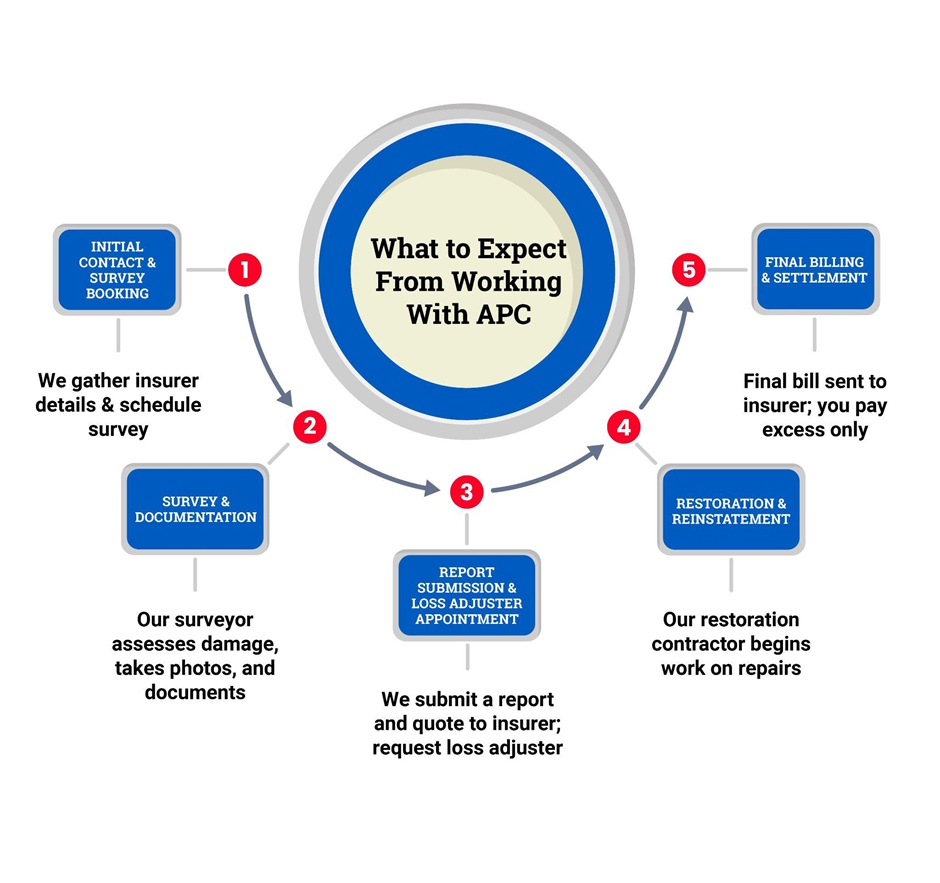

- Reporting: Once property damage occurs, report it to your claims handler as soon as possible. This ensures your insurer is aware of the situation and begins the claims process.

- Assessment: A property damage expert is sent to assess the damage. They will gather documentation, including photographs and estimates, to provide your insurer with evidence of what has gone wrong and what remedial work is needed.

- Final Approval: After the claim is submitted by your claims handler, your insurer will review it. Once approved, they will either arrange for necessary repairs to be carried out or issue a cheque for the amount you’ve claimed.

What Affects Home Insurance Claim Timelines?

Several factors can influence how long it takes for a home insurance claim to be settled. Claim complexity plays a significant role, as more complicated cases, such as extensive property damage or disputes over the cause of loss, may require additional time for investigation and documentation.

Additionally, the insurer’s response time is another key factor; some insurers may have a quicker turnaround, while others may take longer to review claims or request additional information. Finally, contractor availability can impact timelines, as delays in scheduling repairs or finding the right professionals can extend the overall process before repairs are completed.

APC’s Top Tips for Avoiding Long Delays

To ensure your home insurance claim is settled as quickly as possible, it’s essential to be proactive and follow a few key steps.

Prompt Documentation

Documenting the property damage and gathering evidence promptly is crucial for ensuring a swift claims process. Take photographs, keep receipts for temporary repairs, and maintain a detailed record of the damage. This information helps expedite the review process and ensures your claim is processed without delays, as insurers rely heavily on the documentation provided to assess the damage accurately.

Using a Loss Assessor

Loss assessors, like ours at All Property Claims, can significantly streamline the claims process. These professionals work on your behalf to assess the damage, determine the repairs needed, and guide you through the claims procedure. They handle the paperwork and negotiations with the insurer, ensuring everything is in order and reducing the likelihood of delays.

Let APC Help With Fire Damage Home Insurance Claims

At All Property Claims, we’re here to make your fire damage home insurance claim as smooth and hassle-free as possible. Our expert team will guide you through every step of the claims process, ensuring a seamless experience from start to finish.

Best of all, our services come at no cost to you. If we take on your case, the insurer covers our fees. We work hard to maximise your chances of a successful claim while handling all the details efficiently, so you can focus on getting your home back to normal.

Contact us today to learn more about our services or get started on your home insurance claim today.