Water damage is an issue that no homeowner wants to face. However, whether from a leaking pipe or roof, water can quickly infiltrate a property’s structure and damage belongings, requiring repairs and replacements. Acting swiftly is crucial to fix the source of the leak and contain the extent of the damage. Once this is done, it’s time to focus on submitting your insurance claim.

Despite water damage being one of the most common home insurance claims, navigating the claims process is not always straightforward. From understanding the type of water damage you’re dealing with to collecting evidence and submitting the claim, it can be a complex and overwhelming process for many homeowners.

This comprehensive guide will explore the water damage insurance claim process in detail, covering the entire process from start to finish and highlighting common pitfalls to avoid. We will also examine typical cases that may qualify for a successful claim and explain how APC can help you.

Understanding Water Damage

Before beginning the water damage insurance claims process, it’s important to understand what constitutes water damage and the type of damage you’re dealing with.

Water damage refers to the harm caused by water in a home. The presence of infiltrating water can have destructive effects on a property’s infrastructure, including rotting wood and rusting metal.

Water damage is generally divided into two categories: sudden accidental damage and gradual damage, which refer to the rate at which the damage occurs.

Sudden and Accidental Damage

As the name suggests, this type of water damage refers to situations where water damage happens unexpectedly due to an accident. For example, a washing machine leak caused by a malfunction or a broken door seal, or a dishwasher leak resulting from a clogged pipe. These issues are typically covered by home insurance, as the damage is unforeseen and accidental.

Gradual Damage

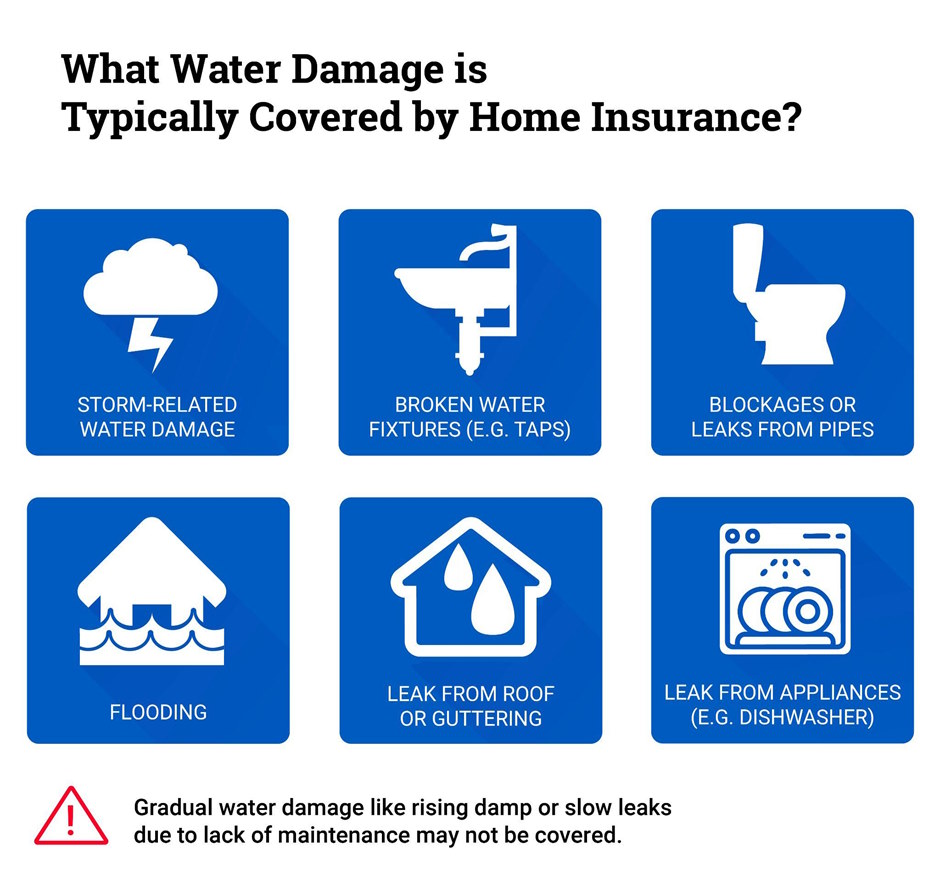

Gradual water damage occurs more slowly over an extended period of time. This can result from a slow leak in a plumbing fixture that goes unnoticed due to the small amount of water leaking. Claims for this type of water damage can be more challenging, as many policies do not cover damage caused by wear and tear or poor maintenance.

To ensure accurate documentation, it’s important to determine the nature of the water damage, as this will guide the claims process and help you navigate it effectively.

What Water Damage Insurance Claims Might Qualify?

Water damage can arise from a variety of situations. Here are some of the most common issues that may allow homeowners to file a claim for water damage insurance claim under their home insurance policy:

Plumbing Issues

Blocked drains, water pipe leaks, and broken water fixtures, are some of the most common causes of water damage. These types of leaks are often easy to spot, and the root cause can usually be determined as a plumbing failure, which an adjuster can verify, improving the chances of a successful claim.

Claims resulting from these types of plumbing issues are generally eligible for insurance coverage, as they are sudden and accidental in nature unless there is evidence suggesting the homeowner has neglected to maintain their plumbing system.

Roof Leaks

Another common source of water damage is water entering a property through a hole or gap in the roof. Roof leaks typically occur when the roof materials are damaged or deteriorate over time, leaving the home vulnerable to rainwater. These leaks can cause extensive damage, affecting the property’s wooden structures, ceilings, walls, insulation, and even electrical wiring.

Normally, the cause of a roof leak is easy to pinpoint, especially when water damage is visible, making it straightforward to identify cracked or missing tiles or other contributing factors. Since roofs typically require maintenance, any maintenance records can help demonstrate that you have kept up with repairs.

Weather-Related Incidents

Extreme weather conditions, such as a storm or heavy and continuous rainfall, can overwhelm a home’s drainage system, leading to flooding. In particular, areas where the foundations are more susceptible to flooding are at risk when water cannot drain properly. This can result in water damage to the lower levels of the property, such as the ground floor or basement.

When water damage is related to the weather, the incident is well-documented by weather forecasts, making it easy to verify the conditions, and providing strong evidence for your claim. Flood damage is included in many home insurance policies, but it is essential to check whether flood coverage is part of your policy. In some areas prone to flooding, an additional policy may be necessary.

An Overview of the Claims Process

To give you a better idea of the claims process, here is an overview of how to file a claim from start to finish, beginning once the water damage or leak has been discovered:

- Mitigate Further Damage

As soon as a leak is detected, it should be addressed immediately to minimise further damage. If the leak originates from a water fixture, start by turning off the water supply. If it’s a roof leak, get a professional to fix the problem as quickly as possible.

- Document the Water Damage

Thoroughly document the water damage. Take detailed photos and videos of the affected areas, as well as of where the issue originated. Create a list of all damaged items or areas, noting their value and keeping receipts or evidence of purchase where possible.

- Review Your Insurance Policy

Carefully read through your policy to check whether the type of water damage and cause are covered under your policy. Also, be on the lookout for any exclusions that could affect your claim.

- Notify Your Insurance Company

With the necessary documentation prepared, call your insurance company to report the water damage. Provide them with details of the situation and be ready to answer any questions. The company will guide you on the next steps, which will typically involve a loss adjuster reviewing the damage.

- Loss Adjuster Assessment

The loss adjuster will visit your property to assess the damage and determine the value of the claim.

- Claim Settlement

After the loss adjuster’s assessment, the insurance company will offer a claim settlement. Compare this offer to the repair and replacement costs to determine whether it is adequate. If you believe the settlement is insufficient, you may choose to negotiate or dispute the claim.

- Water Damage Reinstatement Work

Once the claim is finalised and you have received the payout, you can proceed with repairs and reinstatement.

Common Pitfalls to Avoid

When filing a water damage insurance claim, homeowners can encounter several pitfalls that may jeopardise their chances of a successful outcome. Here are some of the most common pitfalls and how to avoid them:

Not Understanding Your Insurance Policy

Many homeowners do not fully understand the terms and conditions outlined in their insurance policies. As a result, they may submit claims that are not covered by their policies, such as flooding, leading to denial. Always ensure you have a complete understanding of what your home insurance policy covers, including specific exclusions that may require additional coverage.

Insufficient Documentation

Thorough documentation is crucial to a successful claim. A lack of sufficient evidence to support your claim can result in a reduced payout or delays in the claims process, requiring you to gather more evidence. Remember to take clear photos of the damage as soon as it is found before clean-up or repairs occur and keep detailed receipts and records of repair work to prove the extent of the water damage and receive the maximum compensation you deserve.

Missing Deadlines

Insurance companies often have strict deadlines for reporting damage and submitting claims. Missing these deadlines can lead to automatic rejection of your claim. For example, many insurers require that damage be reported within 24 to 48 hours. Review your policy carefully to ensure you meet all deadlines and avoid rejection.

Not Negotiating With Your Insurer

An insurer may offer a settlement that does not fully cover your reinstatement costs. While some homeowners may be tempted to accept the first offer, it’s essential to carefully review it. You may be able to negotiate a higher payout.

Gather estimates from water damage restoration companies to support the value of the repairs you require, helping you justify a higher claim amount. If you’re unsure about negotiating, consider seeking help from a claims management company, which can advocate on your behalf to ensure you receive fair compensation.

How Can All Property Claims Help?

At All Property Claims (APC), we’re an insurance claim management company that specialises in home insurance claims. We do not work for your insurance company; instead, we are an independent third party that manages the insurance claim process on your behalf, ensuring you get the compensation you deserve.

How Does This Work?

Whether the water damage is caused by a water pipe leak or a flood, one of our team members will visit your home to survey and assess the damage. They will also review your insurance policy to determine your coverage and entitlements. We will then meet with your insurer or their loss adjuster to negotiate a settlement on your behalf, providing our findings and documentation as evidence of the claim’s value. This helps to ensure that the agreed settlement is fair.

Water Damage Insurance Claims in London and the Surrounding Areas

If you believe you may be entitled to water damage compensation, get in touch with All Property Claims. One of our helpful team members will listen to your situation and offer advice about your case.