Here in the UK, we’re no strangers to storms – we’ve already had 11 so far since September last year! Of course, just like the weather can’t be controlled, neither (in most instances) can the damage that it causes.

If you’ve experienced storm damage to your home, then you may feel left in the lurch and unsure how to proceed during such sudden and unexpected circumstances. One thing that’s for sure, however, is that you’ll want to make an insurance claim against the damage to your property.

However, how can you ensure that this claim is successful? Whilst you can’t be certain of a successful outcome, there are things you can do to improve the likelihood of this. Keep reading as we discuss just that in this article.

A Brief Explanation to Storm Damage Claims

As its name suggests, a claim for storm damage is a type of property insurance claim for (usually external) damage caused by a storm or other extreme weather event, such as heavy rainfall, hail or a blizzard.

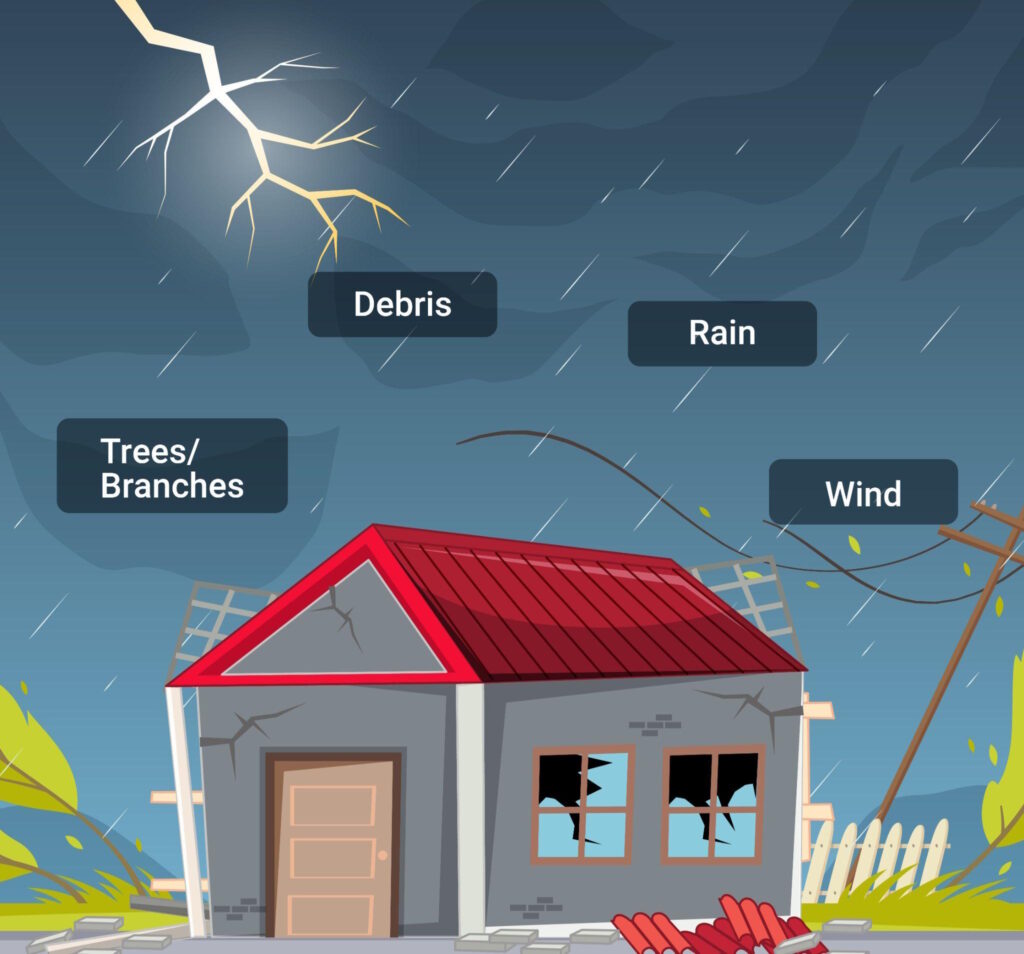

Some of the most common causes of damage seen in storm damage claims include:

- Water damage to the roof caused by rain

- Impact damage caused by trees/branches

- Impact damage caused by debris

- Hail damage

- Water damage from block/overflowed gutters

- Wind damage

It’s important to note, however, that different insurance policies will cover your for different things and will require sufficient evidence to determine the validity of your claim. As such, even if you have experienced genuine storm damage, there are multiple factors that may impact your insurance claim from succeeding.

We’ll explore this in further detail below.

Storm Damage Insurance: Tips for Making a Successful Claim

Know Your Policy

It’s important that you know what you’re covered for under your insurance policy, so that you have a better understanding of whether or not your claim will be rejected without being blindsided by such an outcome.

You should pay close attention to any limitations, exclusions or deductibles mentioned in your policy, as this will help you to decipher what damages are eligible for compensation and which aren’t. By knowing exactly what damage and losses you can claim for, you can set realistic expectations on the payout your insurance company may cover and what damages you may instead need to cover yourself.

Many insurers, for example, will cover external damage, yet may only cover subsequent internal damage if you have accidental damage cover on your policy.

Stay on Top of Premium Payments

An insurance premium is the monthly amount you pay for your insurance policy, so that in the instance you do need to make a claim, you’ll be covered for it.

If you don’t keep on top of these payments, then there’s a chance that you won’t be covered – and thus won’t be eligible to make a storm damage claim. Your insurer is well within their right to cancel your policy if you fail to pay the premium.

It’s also important to note that you are only covered if you have an active policy in place when the damage occurs. For example, if you pay for an insurance policy before you make a claim, but after that damage has happened, then this won’t be covered.

Maintain Your Property

Whilst you can’t stop a storm from damaging your property, there are certain factors that are within your control that could make storm damage more likely or worse, which could ultimately impact your claim.

As a property owner, it’s your responsibility to ensure that your property is well-maintained and in good condition. If you fail to carry out regular maintenance on your home to keep it in good condition and to prevent the chances of property damage from occurring, then this may be seen as personal fault on your part by your insurance company.

For example, you should regularly check your roof and gutters to check for blockages and to clear them of leaves and debris – especially during storm season.

Evidence the Damage

You should always document the damage that has occurred to your property as soon as possible – as long as it’s safe to do so.

This could include taking photos, videos and making clear, extensive notes of all visible damage – all of which will be required of you from your insurer. Make sure to also keep an inventory of any damaged items you own and their approximate value (make sure to also keep the actual items as evidence, rather than throwing them away!).

Not only will this be crucial documentation that your insurer will use to determine the outcome of your claim, but it also allows you to ensure that all the damage and losses you’ve experienced will be addressed, rather than anything potentially being missed by your insurer or their loss adjuster.

Another reason why you should evidence the damage as soon as possible is in case any further damage occurs or existing damage worsens while your claim is being processed, as this can then be documented and submitted to your insurers to also take into account.

Keep Necessary Receipts

Naturally, you can’t predict when a storm may hit and if it will cause damage to your property. With that being said, it’s always best to be prepared in case this does happen in the future.

Because of this, it’s important to keep any physical and/or digital receipts for valuable items that you’ve purchased in case these become damaged, so that you have evidence of their value to include in your claim.

Get in Touch with APC

One of the most helpful things you can do to ensure that your claim is successful is to call us here at All Property Claims. As independent loss assessors, we’re able to help you navigate an insurance claim with the aim of ensuring a fair and equitable settlement on your behalf.

We’re experts in all things insurance claims, possessing the knowledge and experience required to understand technical wording on insurance policies, accurately assess damages and effectively communicate with insurers.

By phoning us and appointing our team to handle your storm or roof damage insurance claim on your behalf, you can rest assured that the process will be prompt, smooth and fair. What’s more, we’ll handle all contact with your insurers from start to finish and will also carry out repairs using our reliable contractors – meaning the only thing you need to worry about is covering the excess on your policy!

Ensure a Successful Claim with All Property Claims

If you ever find yourself in a position where you need to make an insurance claim, whether that be due to storm damage or other types of property damage, then be sure to reach out to us here at All Property Claims.

Equipped with an abundance of experience, we know exactly what it takes to clarify your situation. Get in touch with us today to discuss your requirements and allow us to start the claim process on your behalf – taking the stress off your shoulders.