Climate projections for the UK predict that storms are on the rise, and with a rise in bad weather, damage to your home or property could come with this.

If a freak weather event has hit your house and left it damaged, you should be able to claim on your insurance if you are covered for storm damage. Insurance for storm damage can help to deal with things such as damage to the house from lightning and water damage due to heavy rainfall.

But what coverage can you expect from a storm damage insurance claim? Join All Property Claims as we delve deeper into the topic.

What Counts At Storm Damage In A Claim?

Insurance companies will often try to argue damage is from a separate source, so it is important to know whether or not your damage counts as storm damage before making a claim. This will often involve looking carefully at your insurance documents to understand what exactly is covered by it before you make a claim.

Most buildings and contents insurance policies will cover against storm damage, and if your home is left uninhabitable your insurer should pay for alternative accommodations until the repairs have been made.

Many insurers typically exclude outbuildings like sheds, gates, fences and other outside elements from building and content insurance, so check to see if you are able to make a claim for these things before attempting to.

A storm is typically defined as something that involves violent winds, often accompanied by rain, hail or snow. Your insurance policy may have their own definition of a storm, which will be essential to consult when making a storm damage claim.

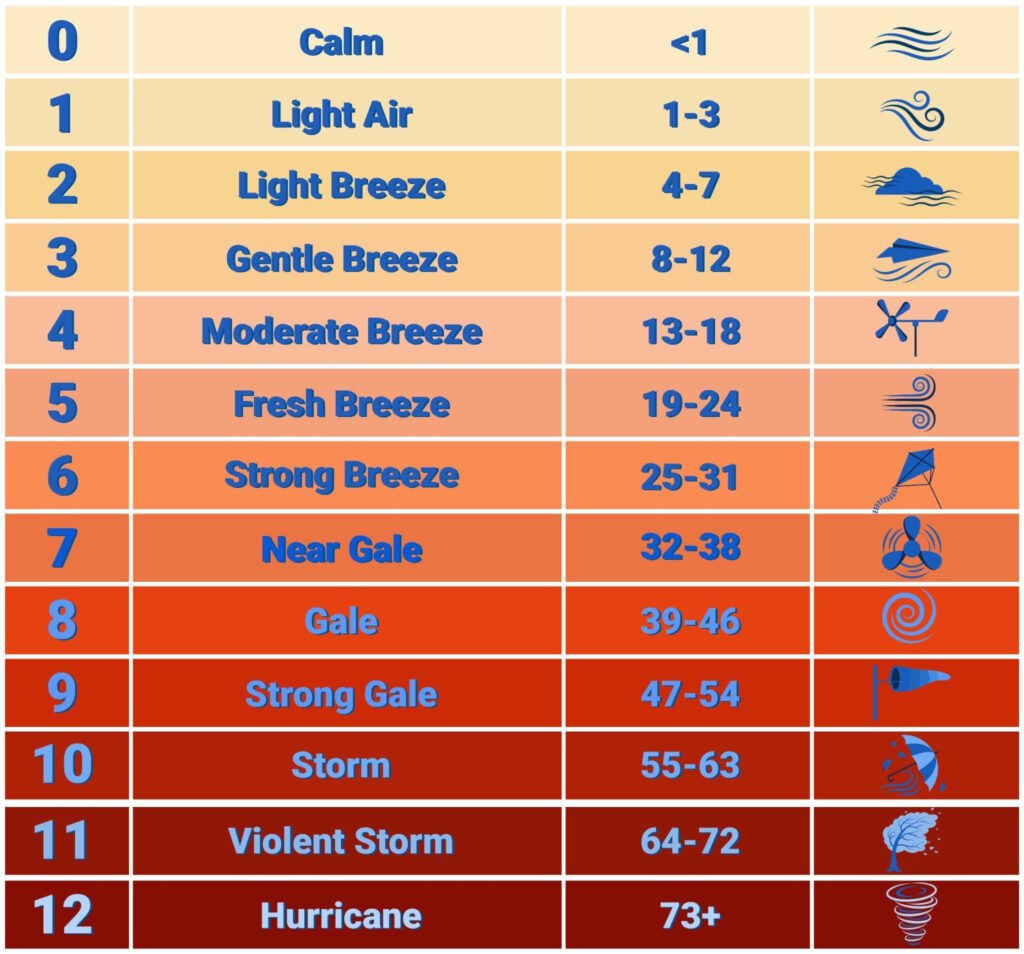

They will typically use the Beaufort wind scale when it comes to defining a storm, possibly only accepting claims when the storm in question is above a certain level on the scale. The Beaufort wind scale is as follows:

Insurers will debate whether there was a storm to begin with, and will typically use this scale and data from The Met Office to determine this. They will look at if there was a storm, how intense the storm was and how close the storm was to the insured property.

Check your terms and conditions carefully surrounding storm damage, as insurers might try to prove the damage was caused by other issues. For example, if your roof is leaking, an insurer will typically pay out if the leak was solely caused by the storm, and is not a result of general wear and tear on the roof itself.

The All Property Claims Process

If a storm has damaged your property and you wish to make an insurance claim, seeking help from All Property Claims is an ideal solution. With us we can help you to get all the reporting needed to make your insurance claim, which will lead to less chance of it being rejected or disputed.

Firstly, prioritise your safety after a natural disaster. While you need to be proactive when it comes to filing an insurance claim, you need to listen to the authorities and ensure your property is safe to enter before you can begin to document any damage that has occurred.

You should always call us first instead of an insurance company, as you may receive the wrong advice or be pressured into saying something that could then possibly be used against you. It may also automatically start the claim process, meaning you won’t be able to engage with a claim management company such as us.

Before you call us, you should document the damage yourself, this way when you contact us you can provide us with all the relevant information to get started with our process. This should include writing down details of everything you believe is broken and damaged, as well as taking pictures to ensure you have proof of the damage.

Once you call us, we will arrive at your property to survey and assess the damage, creating an extremely detailed report on the topic. They will take detailed photos and measurements of all the damage, along with a statement from you about the cause of the damage. Once we have finished this report, we can study your insurance policy and help you understand what you are entitled to.

After that we can then meet with your insurer or their loss adjuster, helping you to navigate and negotiate a settlement of your claim. Your insurance company will likely send a loss adjuster to your property to review the claim, and we can meet them there to help agree on the repair required.

We will then undertake all of your restoration and repair work using our restoration contractors, helping to restore your property as quickly and efficiently as possible. If needed we can also negotiate alternative accommodation for you if you cannot stay in your property during repairs. We will send the invoice directly to your insurer for all costs, so you won’t need to pay anything other than the excess on your policy document.

Storm Damage Insurance Help From All Property Claims

Here at All Property Claims, we are able to assist you in matters involving storm damage insurance claims. We know that any kind of disaster can cause a lot of distress and upheaval, so strive to work promptly to assist you so you can get back to your regular life as fast as possible.

This includes assessing your property and making a comprehensive roof damage report as soon as possible. This report is vital for insurers to accurately cover repair costs and will leave you with everything necessary to make a storm damage claim with as little trouble as possible.

Our service is completely free if we take your case on, and we only make money if your claim is approved. This is why we put so much effort into our services, making sure everything is in order to ensure your claim goes through successfully. We have a remarkable reputation and success rate, with less than 0.5% of claims we have presented have ever been repudiated.

We are able to offer our services in London and the surrounding areas, so check to see if we cover your area here. As well as storm damage, we are able to offer our services navigating a whole range of insurance claims, from fire damage to vehicle impact claims.

If you are after expert guidance in navigating your claim and wish to obtain a thorough roof damage report to ensure your insurance claim goes as smoothly as possible, get in touch with us today.